BLOG

The Whispir blog

Get the best practices you need to foster human-to-human connections.

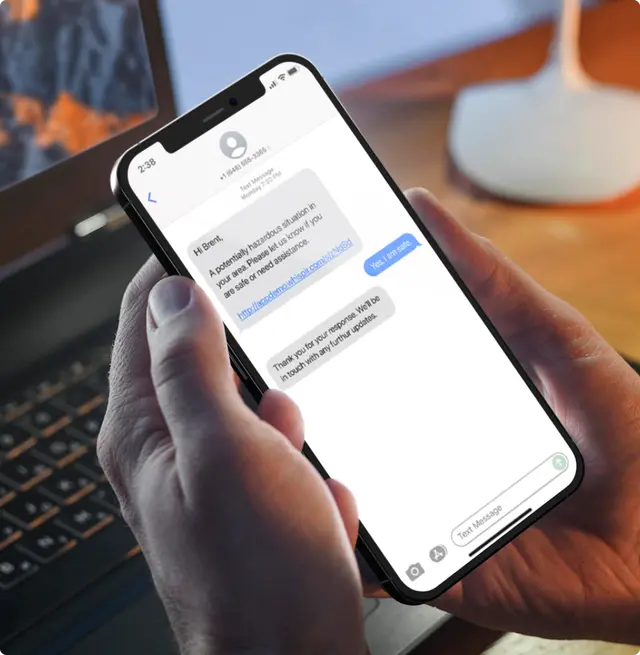

- Crisis communications

- Customer impact

- Tips and Insights

- SMS / Text Messaging

- News and events

- News and events

- Customer impact

- Communication channels

- SMS / Text Messaging

- Automation and AI

- Customer impact

- Tips and Insights

- Communication channels

- News and events

- Crisis communications

- Crisis communications

- Crisis communications

- Automation and AI

- News and events

- News and events

- Crisis communications

- Tips and Insights

- Crisis communications